Digital Financial Systems - Series

In this series on Digital Financial Systems, we are exploring the Digital Payments’ journey in India. In the previous article, we wrote about the incredible run of Digital Payments in a country with such heterogeneity where, as they say, every 2 km, the dialect, the food, the dress and thinking, all change.

While the numbers on Digital Payments do paint an impressive narrative, be it the number of transactions standing at more than 3.83 billion average monthly transactions in FY 21-22 alone, and expected to grow at a CAGR of 15% by 2026, (sources for these numbers attributed in the article here), the journey hasn’t been a seamless and challenge-free one. There have been barriers to adoption for several reasons.

When it comes to consumers/ customers, cash is king. The bias towards cash transactions despite the convenience, speed and flexibility of digital payments, is palpable. It seems the ratio of cash in circulation to India’s GDP was 13.7% as of March 2022 which is an increase from 11.6% just 8 years ago* vindicating the bias towards cash as the primary source for financial transactions. There could be several reasons for this bias; despite the penetration of the Internet and improved connectivity, greater access to smartphones and the proliferation of digital payment instruments, cash is still convenient, a habit and a notion that just refuses to get replaced by its contemporary avatar, at least in the informal sector in India. Lack of financial literacy, unease with using these new modes of financial transactions and the ‘invisible’ costs of cash transactions are contributory factors for not switching to digital payments.

The one-size-fits-all approach is proving to be a major barrier to adoption. Every fintech is designing the User Interface of a digital payments platform, that is like every other UI – they are generic, their form factor is attuned to the more aware and urbane population, and the unavailability of the UI in different languages makes onboarding difficult – making adoption slower and filled with mistrust.

After the consumer response to digital payment channels, and the way we design these solutions, comes the ecosystem in which all of this plays out. Given the demographics of India, and the teledensity (Source: Wikipedia. Telephone density or teledensity is the number of telephone connections for every hundred individuals living within an area), which according to TRAI stands at 58% in rural India, it is perhaps time to think out-of-the-box on delivering payment solutions that eliminate the heavy dependency on Internet connectivity – it is time to think of digital payment solutions that work in resource-poor settings.

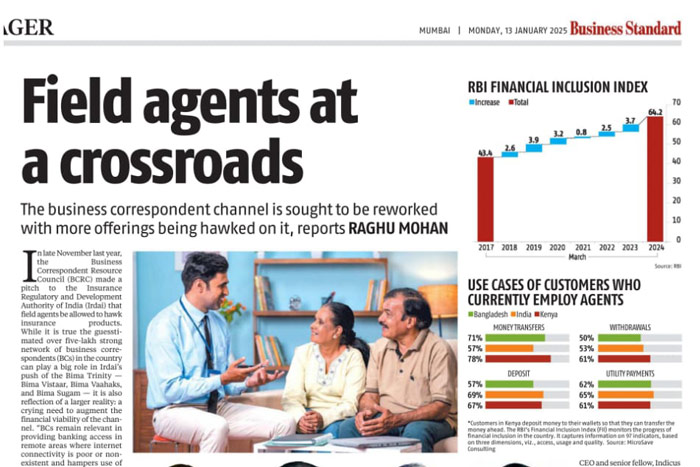

It’s simple really. No internet means no transactions. Quoting some numbers from the NPCI paper, *India has more than 63 million34 micro-merchants, of whom 96% are still underserved by banks and traditional finance companies35. The country has deployed only 6.17 million36 PoS machines, 1.25 million BAP PoS machines, and more than 4.1 million Bharat QR37 codes so far. In addition, Business Correspondents are strapped by the low commissions for financial services rendered. It is time for the Government of the day to work with Banks, NBFCs and social impact fintechs to arrive at a feasible and sustainable commission structure for BCs and reduce the entry barrier for BCs, especially when it comes to setting up and managing the cost of operations.

- *Whitepaper: How digital payments drive financial inclusion in India

- ResearchGate Paper – Challenges in Digital Payments Adoption in India