Business Correspondents Series - Part 3

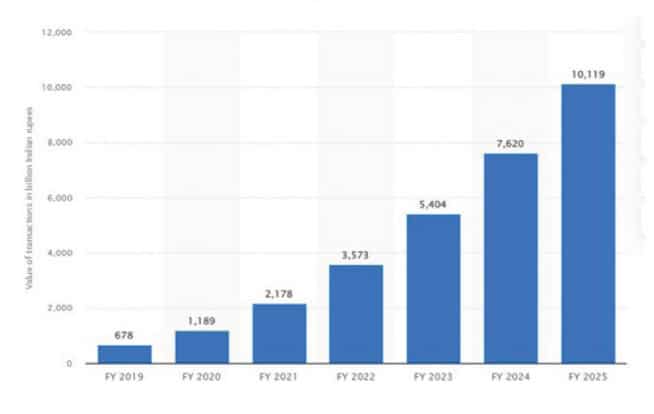

Operating as a BC in India is fraught with challenges. From battling low financial literacy to infrastructural challenges, (you can read more here), and everything in between, operating as a BC in the hinterland of India, can and is very tough. Low margins, low incentives, and insufficient salary structures only compound and amplify the harsh conditions under which BCs operate.

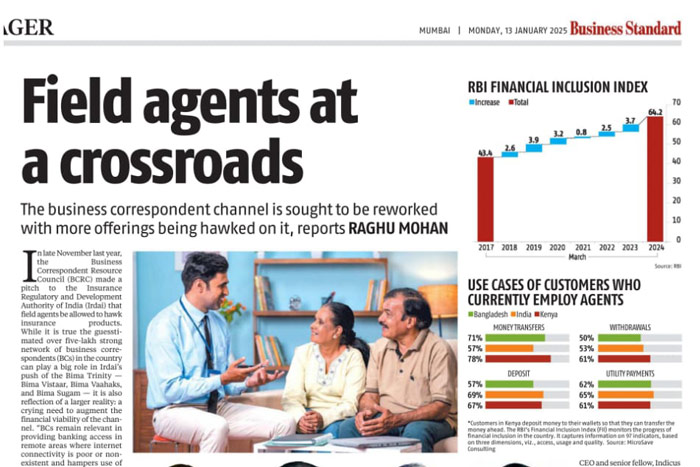

It’s a well-documented fact that BCs have been advancing the goals of the RBI and the Government towards 100% financial inclusion. The BC model is an unprecedented success and the BCs have undoubtedly been at the forefront of Financial Inclusion in India.

Recommendations for improvements in operating conditions

- Mobility – easy access and disbursement of vehicle loans for better and faster mobility across their territories. This would encourage women BCs to extend their outreach and lessen their anxiety about insufficient local transport.

- Increase in revenue streams – low margins and profitability hinder BC growth. Providing alternative sources of revenue streams such as assisted e-commerce can be a feasible solution. BC agents could earn commissions for every product purchased by their customers.

- ONDC assistance – ONDC can offer BCs assistance in setting up e-commerce services and make it more accessible and inclusive for customers in rural areas where e-commerce penetration is lower than in other areas. This would engender trust and convenience and make conversions to banking products and services easier.

- Insurance cover for BCs – providing Insurance cover for BCs to mitigate risks associated with their jobs – such as health cover, life cover, and accident cover – would create a sense of assurance, a surakhsa kavach (safety shield) and motivate more BCs to join networks and increase their availability and outreach efforts.

- Safe cash management – often BCs work in remote areas and are a de facto bank. They have to have the liquidity to manage the disbursement of Govt. benefits under schemes such as PM Garib Kalyan Yojana or transfer of money at the end of the month, or to fulfill sudden cash needs by their customers. Remote areas lack sufficient Internet bandwidth, and hence online or digital transfers can be challenging. Hence a distributor-based cash management system would help BCs, especially during high volume days to replenish their cash shortfall quickly.

- Internet-lite apps –

- It is imperative for fintechs to design and develop Internet-lite applications for resource-poor settings, making digital banking and online transactions easier, faster, safer, and transparent. FIA has developed FINVESTA, a financial services app that works in low Internet settings, proving to be a great asset to BCs working in difficult territories.

- Leverage technology to mine data and customize products and services and work on policies that reflect customer behaviour and consumption patterns.

- Reduce or prevent fraud by ensuing greater compliance and through Risk Analysis of customers, as well as BCs, thereby fostering trust in the customer base.

- Use technology for outreach, training and marketing promotion – create social media promotional campaigns, training or demo videos, policy updates, etc. This will create a virtuous cycle of well-informed, up-to-date, and well-trained army of BCs, providing better service and working towards increasing financial inclusion.

Some of these are easy to implement and some require interventions at the policy level.

To bring about comprehensive change requires deliberate, consistent, and continuous effort from fintechs to work in tandem with other stakeholders including Governments, Banking, and Financial Institutions to be able to create tangible change.

Sources:

- Towards a More Sustainable Livelihood for BCs – FindevGateway

- Addressing 3 key issues of BCs in India for Covid-like challenges – Microsave

- ET Report

- The Next Generation BC Model – Grameen Foundation