Digital Financial Systems - Series

In an economy where cash transactions were de rigueur, the shift to digital transactions on various avenues, while not without its challenges, have been swift and have increased YoY leading to massive transformation in how businesses and day-to-day functioning at the household level are managed.

In India, there are several digital channels for financial transactions, the most popular being the Unified Payments Interface or the UPI, “a system that powers multiple bank accounts into a single mobile application (of any participating bank), merging several banking features, seamless fund routing & merchant payments into one hood,” as defined by the National Payments Corporation of India (NCPI). In addition to the UPI, there are other channels of digital payments such as Aadhaar-enabled Payment Systems (AePS), BHIM Aadhaar Pay (BAP, Bharat Bill Payment System (BBPS), RuPay debit and credit cards, innovative solutions by fintechs such as Gpay, Paytm, PhonePe, Mobikwik, among a plethora of other digital payment solutions.

To quote the NPCI, UPI is the most preferred among digital payment solutions today with around *300 million active users and more than 3.83 billion average monthly transactions in FY 21-22 alone. Ever since its launch in 2016, UPI has notched up impressive numbers – an exponential *CAGR of 270% by volume until FY 2021–22. When you add AePS and third-party apps such as Gpay, PhonePe, and Paytm into the mix, the growth of Digital Payments solutions has proliferated and boosted Direct Benefit Transfers in rural India.

Push from regulators leads to greater adoption

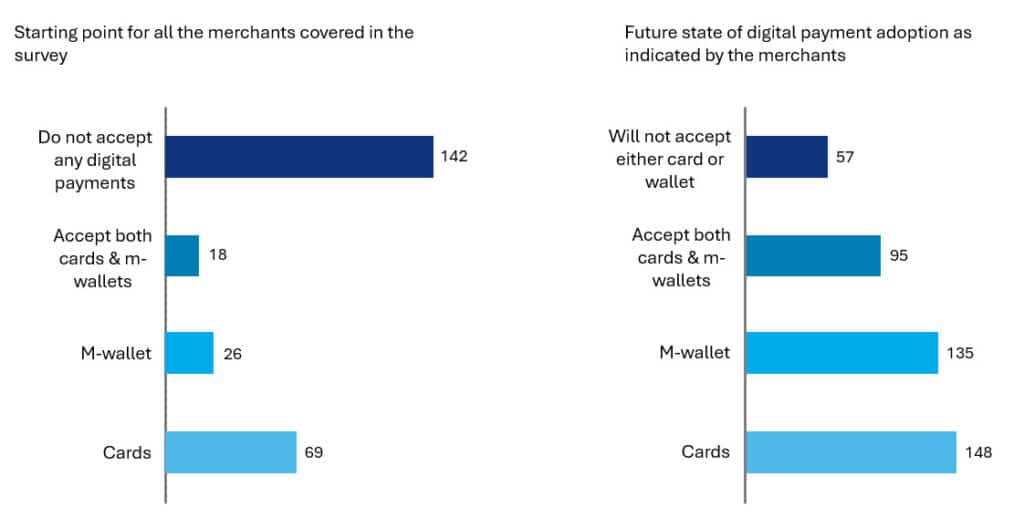

In a predominantly cash-driven economy and with deep-rooted socio-cultural traditions of cash as the primary mode of transaction, the push towards digital transactions, especially in rural India, has reaped huge dividends. With the advent of UPI, AePS, mobile wallets, and other solutions platforms, digital payments have seen accelerated adoption, especially during the Covid years and post-demonetisation. The figure below clearly shows the shift in digital payment adoption pre and post-demonetisation. (Source: Research Gate, Shakir Ali).

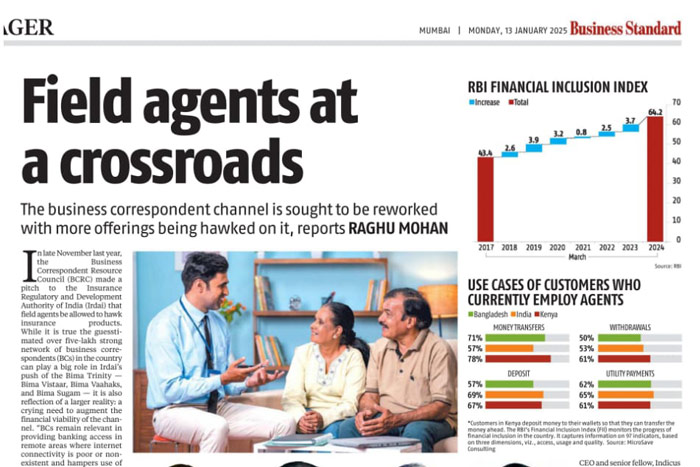

The other significant factor in the rapid adoption of digital payments in rural India is the various Government-led schemes such as the Pradhan Mantri Jan Dhan Yojana (PMJDY) and the Direct Benefit Transfers (DBT). These have greatly benefited people, since they plug systemic leakages and money is directly transferred to the beneficiary using a digital payments platform such as AePS or UPI. Besides, the aggressive push towards adoption with “Digital India Campaigns”, policy and regulatory initiatives, enabling interoperability, payment bank licenses issued by the RBI and several fintechs including FIA Global, have created a momentum towards speedier adoption due to convenience, access and transparency.

This has led to a domino effect – the adoption of digital payments has led to an increase in economic activity, which in turn has led to greater telecom penetration, fintechs and banks competing to serve the underserved or unserved in these geographies. In fact, according to the McKinsey Global Payments Report 2022, the non-cash transactions between 2018-2021 **“at a compound annual growth rate of 13 percent; while in emerging markets, that figure is 25 percent,” and strong growth is expected in emerging markets – **projected CAGRs of 15 percent between 2021 and 2026.

Sources:

- *Whitepaper: How digital payments drive financial inclusion in India

- **The 2022 McKinsey Global Payments Report

- ResearchGate Paper – Digital Payment for Rural India- Challenges and Opportunities

Aishwarya C

Aishwarya C is the Marketing Lead at FIA Technology Services Pvt. Ltd., India’s leading social impact fintech working in the area of financial inclusion in India’s underserved geographies.