Since its launch in 2015, the vision of Digital India is something the country has been working towards in a bid to adopt and harness digital technologies. In keeping with this trend and to increase their digital footprint, banks have also adopted new technologies and expanded services to various digital channels.

Today, customers increasingly prefer digital platforms for all their transactions and banking requirements. However, there’s a catch. Going digital also means the possibility of cyber threats and the need to tackle them effectively.

After the demonetization of November 2016, and with India’s push for a cashless society, the need for cyber-security has become more relevant and important. It has become imperative to address the cyber-security issues that are on the rise.

With cyber criminals using more sophisticated methods to hack apps and gather customer information, the need to tackle cyber crimes has become an urgency. Accordingly, the banking sector has proactively invested in improving security practices.

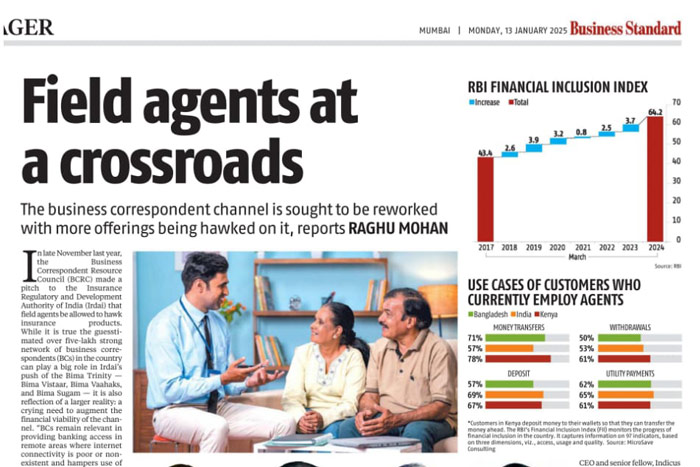

Digitizing the Last Mile

The influx of digital solutions has created a lot of confusion and instilled fear among customers, especially those at the bottom of the pyramid. The reasons for this are many – wider information gap, poor infrastructure, low literacy, and lack of product awareness.

Apart from this, there is a lack of transparency on new product launches and pricing structures – and more importantly, a lack of clarity on who is responsible in case of liabilities. Furthermore, there is insufficient information on the security measures taken for digital products and technologies.

In case of cyber-security breaches, the ones that bear the burden of proof are last-mile customers, agents, and financial aggregators.

Tackling the Cyber-security Problem

To begin with, financial literacy is key. For this to happen, a unified multi-stakeholder framework is necessary. Also, financial education should be integrated and made a compulsory part of the school curriculum.

The RBI and the Government of India must allow the existing products and models to stabilize. The pace at which new business models and products are being introduced needs to be slowed down.

A consumer protection framework must be put into place that encompass all stakeholders in the financial ecosystem. Regulators must promote a common cyber-security framework and invest in cyber intelligence networks. They should also collate and publish unified pricing and costing information.

Categorization and quantification of losses due to disruption of services and fraudulent activities could be an option. The Indian cyber community’s computer emergency response team should publish a rating system for Fintech and new technologies regarding cyber-security, and address all imbalances through regulation and cyber insurance.

Measures to ensure consumer protection while digitizing payments, especially for those at the bottom of the pyramid, needs immediate attention. Focusing on the last mile during this journey of rapid digitization is of utmost importance to make Digital India a successful reality.