Societies today are pushing for worldwide financial inclusion. If you have a bank account and are a part of the banking system, you probably take your inclusion for granted because you have ready access to an array of financial services.

But did you know there are billions of people who do not have access to any of these services? In fact, there are many who don’t even have a bank account! The World Bank estimates that about 1.7 billion adults lack access to one.

What is Financial Inclusion?

Financial inclusion involves the availability of sustainable, useful financial products and services for all business and individuals, regardless of company size or individual net worth. It makes financial services such as banking, insurance, equity, etc. available equally to all, without discrimination.

The main aim of financial inclusion is to get rid of the barriers that prevent certain people from gaining access to the financial sector, and reap the benefits of the services that improve lives. This will enable weaker sections and low-income groups to avail of timely, adequate credit at a reasonable cost.

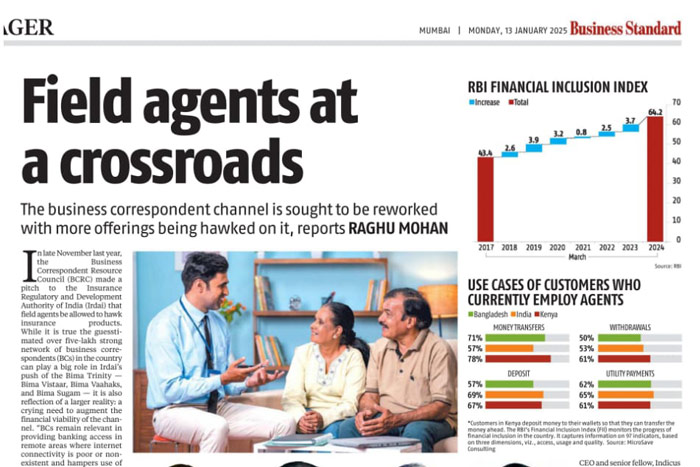

Vision 2020 of the Reserve Bank of India (RBI) is about banking the unbanked. It aims to drive 600 million people to open new bank accounts and leverage IT to service these new customers. The World Bank too has a similar vision called Universal Financial Access 2020, with the goal of ensuring that 1 billion unbanked adults have a basic bank account by 2020.

Need of the Hour – Banking the Unbanked

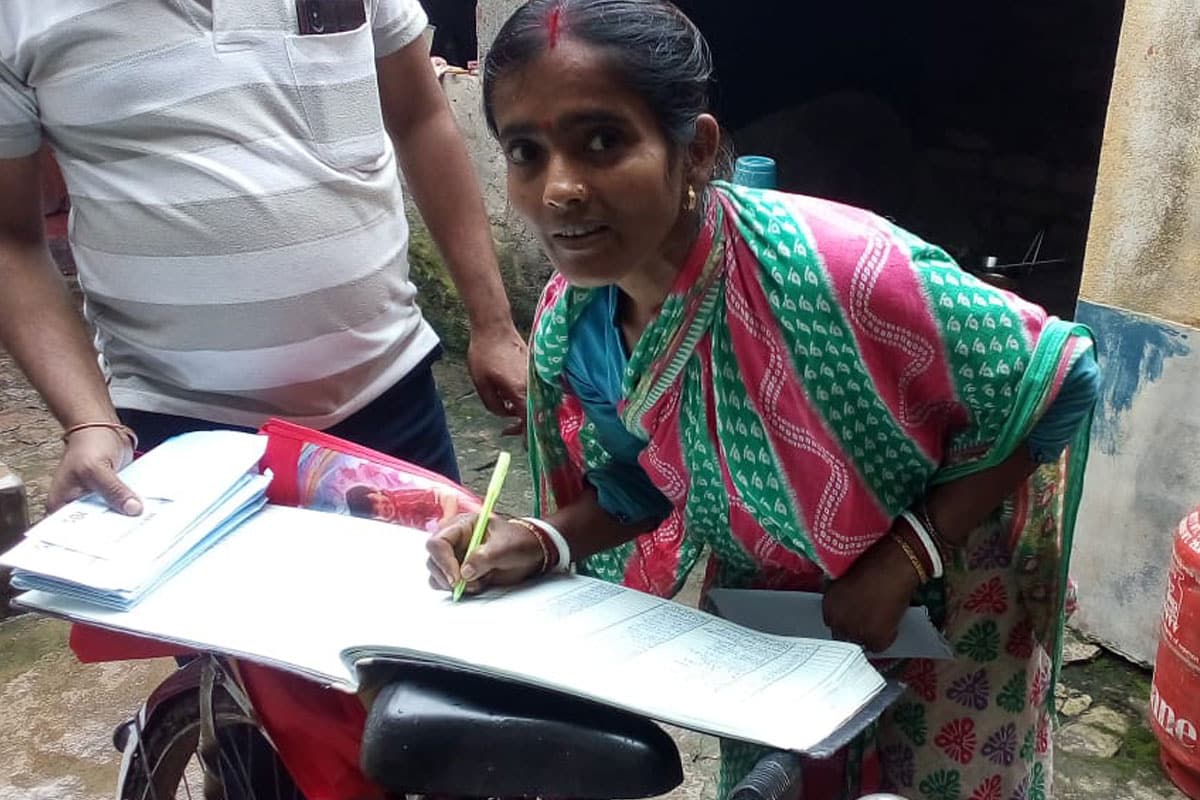

The roadblocks on the journey towards universal financial inclusion are illiteracy, shortage of bank branches in rural areas, and low-income savings. To thrive in today’s world, it is a necessity to be a part of the financial system.

Rural societies, if given access to modern banking, can prosper immensely. For this, one of the important requirements is financial education. Financial literacy and knowledge about personal finances is important to help people who are new to the banking system make informed decisions and avoid pitfalls.

The essence of financial inclusion is to ensure delivery of services such as bank accounts for savings and transactions, low-cost credit, financial advice, insurance etc. A large segment of the population that remains unbanked lacks access to credit at a reasonable cost. This forces them to rely on informal channels to meet their credit needs, where they tend to get exploited. This results in financial instability among the low-income population, especially in rural areas.

Financial inclusion is the solution to these problems. It helps improve the efficiency of delivery of public services like subsidies and pensions, and ensures that they directly reach the intended populace. Additionally, it also creates awareness – it throws light on pension and rural employment social security schemes, as well as availability of alternative investment options such as insurance and mutual funds.

Initiatives for Financial Inclusion

The Indian Government initiated the successful Pradhan Mantri Jan Dhan Yojana (PMJDY) that aims to provide the unbanked with universal banking services and serve the unserved and underserved geographies. The implementation was taken digital by linking the bank account with Aadhaar and mobile.

The government also introduced Pradhan Mantri Suraksha Bima Yojana, Pradhan Mantri Jeevan Jyoti Yojana, Atal Pension Yojana, and Pradhan Mantri Vaya Vandana Yojana with the intention of making social security and insurance affordable to all, down to every last citizen.

The Birth of FinTech

With continuous efforts being made to ensure that the global population has access to financial services and products, financial technology or FinTech is increasingly gaining importance. It empowers the financial industry with tools that help overcome problems – such as catering to inaccessible areas – and devises new ways in which banks can provide services to the masses at reasonable rates. In recent years, FinTech has aided developments such as going cashless with the help of digital transactions.

The Way Ahead

The RBI’s annual report for 2016-17 shows the progress being made with respect to financial inclusion. Its efforts have increased the number of bank branches in villages from 33,378 to over 50,000, while the number of basic savings accounts shot up from 73 million to 533 million. PMJDY has been the biggest game changer so far; it facilitated the opening of 316 million new accounts and deposits that exceeded Rs 800 billion.

The journey is long and difficult, but the progress is encouraging. Ongoing efforts focus on providing improved access to government services, Wi-Fi in public areas, and internet access to 2.5 lakh villages. The Aadhaar program has also been a success as it promotes access to financial services among the unbanked. With innovative ideas and tools offering a significant leg-up, financial inclusion is sure to benefit many more people in the years to come.