An ecosystem that has transformed significantly over the past few decades, the financial services industry is a complex environment. Many reasons fueled its transformation, including internal and external factors such as technological advancements, evolving business models, and regulatory changes. New complexities always arise, which require changes in risk management procedures and systems that are currently in place.

A risk is the uncertainty of the occurrence of an event in the future. In finance, this refers to the bank’s exposure to the uncertainty of an outcome. New technologies, regulations, types of players, and changes in consumer behavior – all of these need to be taken into account while addressing possible risks that occur as a result of these changes. Banks have borne (and continue to bear) losses running to billions due to careless and misguided risk-taking. There are various types of risks faced by banks, which include strategic and compliance risks, cybersecurity risks, market risks, credit risks, liquidity, and operational risks.

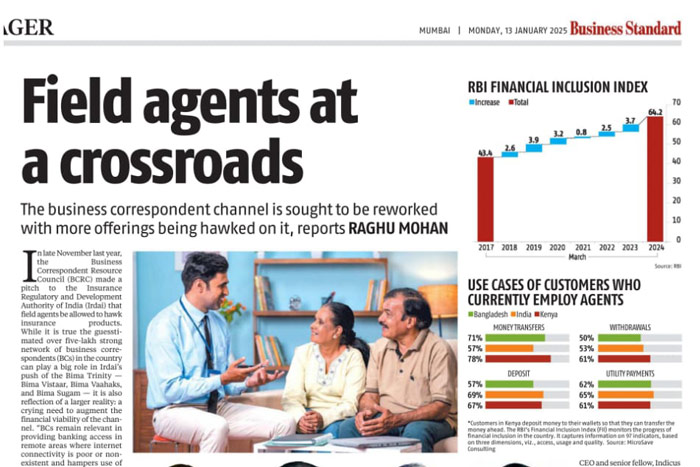

To enable better reach and to get their services across the last mile, financial institutions make use of distributed outreach networks. These help in banking the unbanked by ensuring that the services reach them. But these networks do face certain risks. Let’s look at the common risks faced by distribution networks and how they are mitigated.

RISKS AND HOW THEY ARE MITIGATED

1. Risk of network interruption

The flow of information and strategic direction from the core to the nodes can get disrupted and diluted by mid-level resource centers. This includes zonal/regional management, mid-level managers, and channel owners.

Mitigation strategy:

- Assessment of last-mile alignment through assurance audit

- Governance model to include planning and review for the last mile

- Strategy meeting with zonal players

2. Risk of dependency on single-port network management

Distribution network management from a single operational window increases the risk of business continuity.

Mitigation strategy:

- Business continuity plan with parallel support centers

- Allocation of senior resources across geographies

- Sharing of skills and experience across nodes

3. Risk of de-alignment (non-consensus)

Various nodes or distribution networks work with different beliefs and value systems, leading to highly localized, vested business interests.

Mitigation strategy:

- Senior leadership engagement at zonal/regional centers

- Spread and movement of resources at periodic intervals

- Re-visit or re-evaluate KRA of deputed officials at regular intervals to reinforce alignment to organizational goals

4. Risk of power pole formation

Power poles or power centers originate within distribution and network structures, preventing impartial and equal-opportunity business space. This goes against the organization’s interest.

Mitigation strategy:

- Strengthening corporate governance

- Inter-departmental transfers for development of new skills and professional value addition

5. Behavioral risk of third-party agents at the last mile

Lack of cost-effective monitoring at points of sales might lead to unethical conduct of business with low or no control on market conduct. This leads to potential fraud, mis-selling which is of huge reputational risk.

Mitigation strategy:

- Field level monitoring and audit as a part of routine deliverables with zero tolerance for gaps

- Investment in technology and analytics to develop fraud control tools for alert generation

- Deployment of a grievance management mechanism to capture and analyze customer’s voices for early identification of gaps and corrective actions.

These, then, are some common risks distribution networks face, and a few of the many possible mitigation strategies. With technology developing at lightning speed, it will be interesting to see how mitigation strategies transform as technological advancements help in improving the security of financial transactions.