Digital Financial Systems - Series

In the previous 2 articles on Digital Payments and Inclusion, we discussed various facets of the digital inclusion ecosystem in India, some astonishing numbers ever since its introduction, and how, despite its popularity and convenience there were barriers to its speedy adoption.

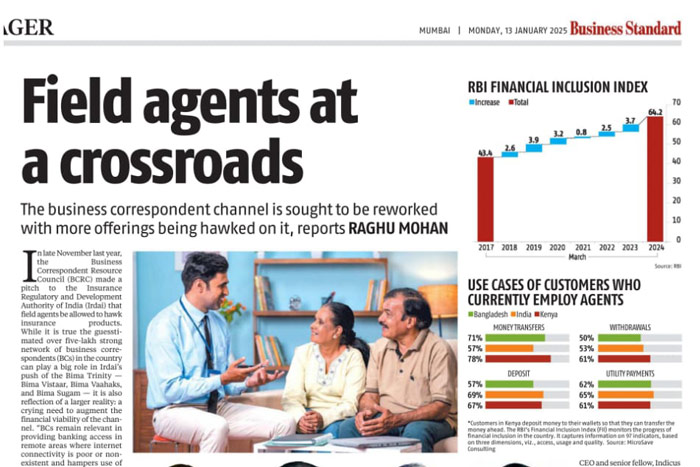

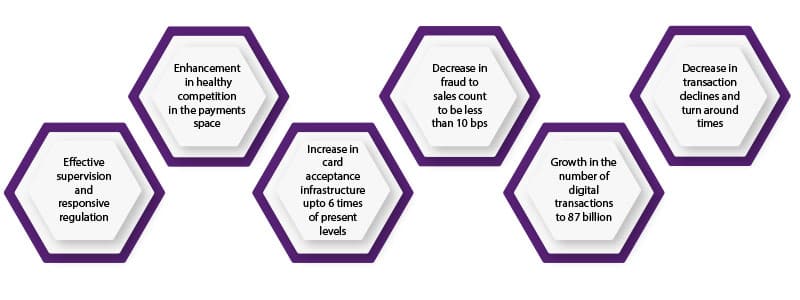

The Reserve Bank of India’s Payments and Settlement Systems in India – Vision 2019-2021 – was to, “Empower every Indian with access to a bouquet of e-payment options that is safe, secure, convenient, quick and affordable.”* One look at the expected outcomes depicted in the graphic below will reveal that the digital payments systems must be strengthened on three fronts – robust infrastructure, future-ready regulation, and customer-centricity – to increase the velocity of adoption.

Solutions toolkit

1) Large swathes of the underserved or unserved population in India are not English-speaking and face severe challenges in the way the systems are designed. The Low and Middle-Income segment feels a sense of overwhelm when faced with digital payment systems. Other innovative solutions such as Voice-activated technology or contactless payments could pave the path to enhanced usage. Safe, robust and user-friendly designs with multiple language interfaces would also go a long way in mitigating the resistance to adoption.

2) One of the key issues the non-urban population faces, is that of trust. The role of ‘cash is king’ continues to be popular while modern digital payment systems continue to be viewed with suspicion and distrust. Gaining trust with grievance redressal mechanisms, robust systems that work in resource-poor settings, so that Mahima or Gopal or Ramakant do not have to worry about their money being ‘stuck’ or ‘disappear’ or ‘lost’ would help in establishing trust and gain the users’ confidence.

3) Given the different use cases for digital transactions, one of them being G2P (government to people), the transaction systems have been digitized, the Aadhaar enabled Payment System is a case in point. This opens up huge potential for increasing the infrastructure of P2P, B2P and P2B (People to People, Business to People and People to Business) digital payment systems that can help drive rapid adoption. Some of the use cases are:**

i. P2P could include remittances – both domestic and international. At FIA, our domestic remittance channels see huge traction because they are convenient, accessible, quick and safe.

ii. P2B could be merchant payments,

iii. loan repayments, etc. According to the NPCI paper, the market size is 5.8 billion.

iv. P2G use cases could include utility bill payments, purchase of fuel, public transportation, etc.

v. B2P cases could be payments from FPOs or cooperatives, salaries, and here again, the potential is huge with a market size of INR 3 billion per year and growing.

4) Safe, secure and interoperable digital platforms could further drive the speed of digital payments adoption. India’s fintech market opportunity is slated to grow to a jaw-dropping 2.1 trillion USD by 2030***. While the fintech sector is robust, the need to build better, safer, and more secure digital financial solutions, with a very high threshold of ‘potential fraud’ will accelerate the adoption of digital payments across the country.

5) Government and regulatory bodies would need to revisit policies on data security, privacy and compliance and strengthen them to garner trust and boost digital payment adoption. From licensing P2P lending platforms to creating guardrails for borrowing, and payment transactions, the RBI and other governing bodies such as SEBI, IRDAI, etc., need to ensure that customers’ interests are safeguarded. Perhaps the multiplicity of policies and rules on Financial Services needs to be streamlined and the RBI needs to work on a uniform set of fintech rules.

**PwC estimates indicate that the volume and value of digital transactions in India will reach INR 167 billion (USD 2.25 billion) and INR 238 trillion (USD 3.21 trillion) by 2025.

- *Payment and Settlement Systems in India – Vision 2019-2021

- **Whitepaper: How digital payments drive financial inclusion in India

- ***Industry Scenario – Funding and Valuation – InvestIndia.gov.in