With low premiums and low coverage, micro-insurance today is sold as a typical risk-pooling. It refers to protecting the lower-income groups from specific perils. These perils are very much like that of a middle-income group, but with a higher financial impact due to the and occur in higher frequency. An individual from a lower-income group is far more vulnerable and his losses are further magnified every time they incur a loss. The vicious cycle is set in motion and with each cycle human and economic welfare is far-fetched and greatly precluded.

For the poor, managing risk is mostly achieved by means of their own. Risk here would mean injury, loss of life, property or crop. Poor depend on informal mechanisms for cash flow such as borrowing from money lenders, asset ownerships, savings, rotating savings and credit associations in order to cope with contingencies.

The Problem Statement for Micro-Insurance

Mr Njeru is the CFO of Pula- a 4-year-old micro-insurance firm that serves 1.7 million smallholder farms in 10 African countries and India. Njeru was motivated to provide protection for low-income individuals who lacked conventional coverage. Having grown up on the slopes of Mount Kenya, he saw firsthand the devastating impact of small setbacks that landholders faced, that included his own families. The founding of Pula brought to the forefront the problems faced by farmers, which needed quick resolution. Pula partnered with governmental agencies in India and Africa to provide loans that cover seed and fertilizer costs, without directly charging the farmer. Pula also provides a weather index insurance that covers costs of failures in seed germination, with the help of satellite data. So that in the event of a poor harvest, the farmer is provided with replacement supplies.

Much like Mr. Njeru’s experiences and conditioning, Seema, too was compelled to work towards eradicating poverty by financially serving the underserved. She managed success through her organisation ‘FIA Technology Services Limited’ that has brought a comprehensive range of sachet financial products and services to the rural landscape of India and Nepal; micro-insurance being one of their key products. FIA has managed to tie with the country’s largest public and private sector banks along with 300+ community-based organsiations with close to 28000 inclusion centres in the remotest regions. Through their almost viral network of agents, FIA brings doorstep banking to the fore, catering to life, vehicle, livestock and medical insurance all for the poor; a sector that major urban retail insurance providers refuse to venture into.

“Small livestock owners and farmers are sadly just one drought away from sliding into complete poverty”, – Seema Prem – Interview with CNN TV18 and CNBC

In case of both companies, Pula and FIA Technology Services Limited the coverage is registered via a mobile app. In case of FIA, there is some paperwork that is taken forth by the banking agent in the district.

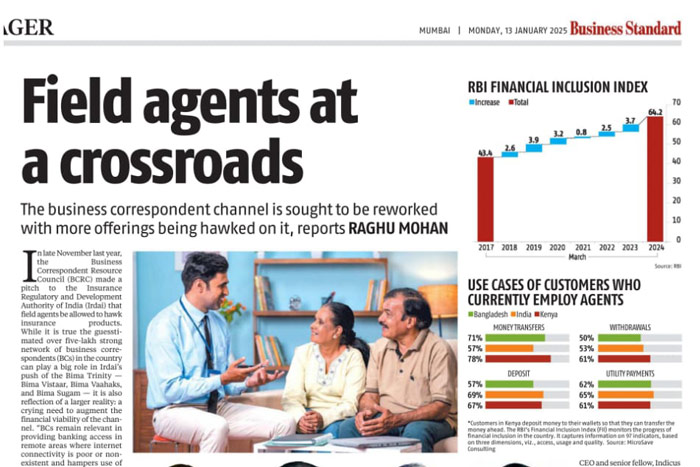

Insurance is a $64 Billion market globally, and yet has been slow to catch on in the remote parts of developing worlds. This can be attributed to logistical hurdles, where farmers are hard to reach due to difficult terrains. Verifying claims come at a cost which is high for this subsistence market. A rural-focused channel distributor incurs very high expense to ensure access and adoption of insurance policies by rural customers, especially those who are semi to illiterate. To educate the population, then enroll them involves advisory, where agents are empowered to help farmers inculcate a saving habit. Most micro-insurers are now leaning towards improving efficiency with the help of powerful data acquisition and satellite-enabled weather forecasts that have been proven strategies for risk-sharing among larger insured groups and nonprofit structures.

Agents are incentivized by as less than 0.25% of the insured sum, which almost never covers overall costs of reaching the customer. The agents also land up spending more time in processing documents due to low internet connectivity in these remote areas where his customers reside.

Despite efforts pouring in from all sides, the sad reality remains that a majority of farmers face a very precarious future when it comes to their crops and livestock. Micro-Insurance largely overlooks agriculture and livestock since they are risk-heavy. The penetration of micro-insurance in the remote areas of India is less than 2% since most MFIs are not ready to serve the unique needs of this sector.

Organizations like Pula and FIA are in fact leading the way when it comes to protecting the interests of the insurers. and support vulnerable smallholders. They are primarily driving behaviour change toward adopting insurance especially in the rural and poor households who are faced with many competing demands on finances.