Financial inclusion is on the agenda of every government that comes to power. Why?

The reason is simple, economists and social anthropologists have always believed that financial inclusion is critical for a nation’s growth, well-being, and prosperity.

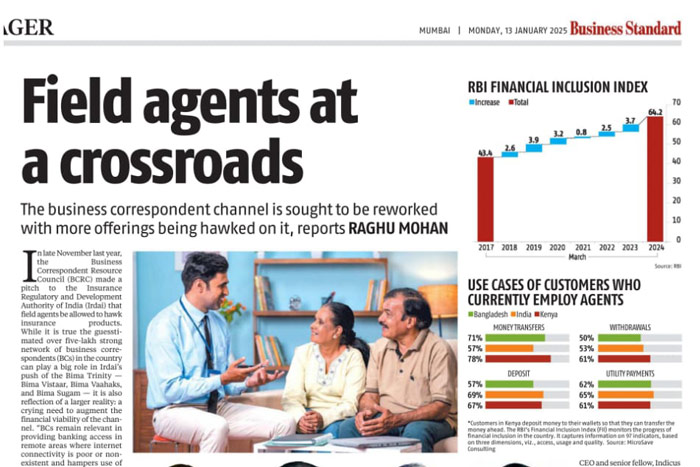

India continues to languish at the near-bottom of the list of countries with the second-highest number of unbanked people, standing at 190 million people.

Unbanked or underserved people are an opportunity cost that a nation such as India can ill afford.

190 million people with bank accounts, savings, accessing capital, and using the full suite of financial services means the economic engine of the nation is in the 4th gear, racing ahead.

However, in the past several years, the government has been focused on bringing more people under financial inclusion.

According to an official of the Ministry of Finance (MoF), “while the first phase was to bank the unbanked, secure the unsecured and fund the unfunded, now we are working on incentivising digital transactions by providing various tax and non-tax benefits to customers and merchants,”

The official of MoF was referring to the efforts by the GOI to push financial inclusion to the next level. What does the next level mean?

As of March 2022, the cumulative balance in the Pradhan Mantri Jan Dhan Yojana (PMJDY) stood at 1.63 lakh crores with approx. 45 crore beneficiaries.

The next level is financial inclusion through convergence

The government is planning on scaling up financial inclusion through convergence by asking banks to find linkages between different Government-funded benefit schemes such as Atal Pension Yojana (APY), PM SVANidhi Yojana or Sukanya Samriddhi Yojana to the Jan Dhan accounts.

This linkage will help banks and fintech companies to expand the digital footprint of banking transactions and open up opportunities to offer and deliver a slew of relevant and suitable financial products to the right target segment.

From crop insurance to medical insurance or loans to micro or MSMEs could become easier to target, offer, deliver and monitor.

This convergence of one account, omni-product benefit, was perhaps the most natural progression towards financial inclusion.

Consider these facts: according to a report called “The Poster Child” by the Boston Consulting Group, over 75% of all digital payments and digital loans and 25% of digitally opened accounts will be transacted on 3rd party applications.

This seems to be borne out by the record number of digital transactions conducted in November of 2021 alone at 4.23 billion, valued at 7.56 lakh crores.

Every metric seems to be favourable towards digital transactions and the Unified Payments Interface (UPI) has emerged as the financial digital interface of choice having processed 9 billion contactless merchant transactions in FY 21 alone.

FIA geared up with FINTAP

We at FIA Global, are already geared for this next phase of financial inclusion with our uber, next-gen Artificial Intelligence powered Machine Learning driven app-based solution, FINTAP.

It solves coverage, access, and products. Its analytics-based approach will help our banking partners to identify the right products and, based on transaction patterns, help micro and MSMEs with instant loans, among a plethora of services.

Next phase, technology-fuelled convergence

The digital route for access to capital by way of loans especially would mitigate the problem of loan sourcing that micro and MSMEs have been facing.

Convergence of services would help bridge the yawning credit gap of 240$ billion that India’s MSMEs are challenged with, particularly in rural, hard-to-access geographies within the country.

According to Sunil Mehta, the Indian Bank Association’s Chief Executive, digitisation of the banking sector will boost retail, one of the key sectors of the economy, and this kind of convergence will also aid and assist MSMEs in the ease of doing business.

With regulatory bodies, government agencies, banks, and fintech companies working together, financial inclusion is set to enter this next phase of technology-fueled convergence.

Keywords: Financial Inclusion, MSME, Ministry Of Finance

Source Credit: Centre maps out way to scale up financial inclusion, ET Bureau, Dec 2021