In a market economy, the availability of and access to finance is crucial. Historically, women have been victims of unconscious bias in financing or credit decisions.

The lack of women leaders in financial services is an obvious example. Banking is an industry founded by men, run by men. The gender bias runs deep and women face a handicap that reduces the likelihood of getting financing – and all of it points to implicit discrimination.

Another notable example of this imbalance is the unconscious gender bias that extends into start-up funding and, spoiler alert: women who venture into entrepreneurship do not always get a fair deal. In 2018, only 3% of venture capital in the US went to businesses with a female CEO, according to the Harvard Business Review. This bias within the venture capital industry, as the authors argue, is preventing funds from being allocated to the best investment opportunities.

Understanding unconscious bias

Unconscious gender bias is defined as unintentional mental associations based on gender, traditions, norms, values, culture, and/or experience. We all have biases–conscious or unconscious.

As Joelle Emerson in Harvard Business Review puts it, we don’t have unconscious biases because we’re bad people – we have them because we are people.

In financing, one potential bias is that women entrepreneurs might experience greater difficulties than their men counterparts. Undeniably, women-led businesses would often experience tougher credit access, which would result in negative consequences on business, employment, and the economy.

Systems fail women

In India, whether it be working capital or a motorcycle loan, which is a traditional non-controversial financial product, financial institutions and credit companies impose that:

- Female borrowers should have a co-guarantor–either husband or father;

- Single women are not eligible, citing reasons for future marriage, relocation, etc.;

- Credit history is required.

The financial services industry is a business of balancing risk and reward – as it should. However, some, if not all, of the above requirements reflect a flawed financial system design, which fails women and causes them harm. It brings us to ask, can financial algorithms create results that are systematically prejudiced against people based on gender? Is it possible for credit or banking tools to quickly and systematically screen out women from the list of lending applicants?

According to research commissioned by Women’s World Banking, algorithms that are created and run by machines can be biased just as humans can be. The study highlighted an input from an interviewee, “Algorithms were written by people, and people come to the desk with a preexisting bias that will get coded in.”

Change must be structural

Technology will not ignore biased data unless programmed and trained to do so. This is why change must be structural, from management down to the relevant systems in question. In India, an inclusive system design that does not outright disregard the 75 million single Indian women is needed.

The government, primarily of the Ministry of Women Development, should work to champion the fair representation of women. Financial institutions must identify what qualifications matter before making people-related decisions.

Executive leadership or management teams need to invest time and effort to factor in women’s point-of-view in the product, policy, and process design. They need to create end design financial applications that are more accessible to women.

Financial institutions, venture capital firms, and credit companies can put their money to foster inclusion and diversity at all levels and across programs. Decision-makers should take it upon themselves to identify where their organization fails in terms of fairness and clearly define institutional and organizational processes thereafter.

Awareness is a great first step

Where biases can be a huge issue is when they are left unrecognized and unchecked. Realizing that financial services and credit companies may be unconsciously and unintentionally displaying gender biases may help.

Acknowledging that unconscious bias can negatively impact women individuals and entrepreneurs is a great first step in opening a more inclusive, fair, efficient future for all. The awareness of unconscious bias can and will lead to reversals in biased outcomes.

But for now, our takeaway is this: tackling unconscious bias in financial services can prove meaningful, but only if steps to innovate financial systems and processes are thoughtfully designed to reflect diversity and inclusion efforts.

Where to from here?

While The Reserve Bank of India (RBI) ponders the fate of the NBFC-MFI model, it also needs to acknowledge the strength of its more than 90% women clientele – and implement forward-looking, gender-neutral policies, with a specific focus on empowering women.

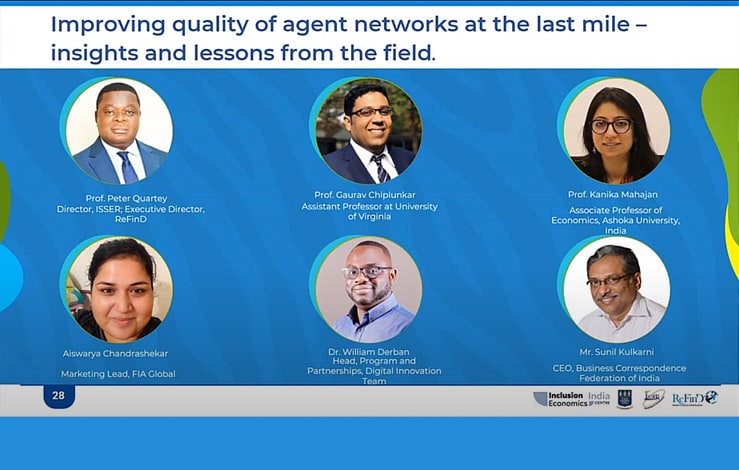

At FIA Global, we learn from these societal mistakes and leverage new tools for women’s financial inclusion today and in the future. We act on the imperative to design for excluded customer groups, especially women individuals or entrepreneurs, to develop new services geared to women, and transform and level the playing field.

By correcting such unconscious bias, we open new financial access to women and help them achieve better economic results, and empower them to compete in the marketplace. It is critical for us to recognize bias in ourselves.

FIA Global supports Indian-based micro-enterprises, which have invisible credit history and often rely on expensive sub-prime credit, with technology intervention to grow their business at scale. We are aware of the limited and costly access to financial services, and we work to deliver affordable, risk-optimized products to un(der)served customers in emerging markets.