Since traditional banking has several roadblocks in the procurement of loans for MSMEs, fintechs and NBFCs are bridging that gap.

Banking services today in most urban metros has changed from the traditional banking of our parents or the previous generations. Today, the Internet and digitalization of financial services has changed the face of banking – from checking our bank balances, transferring money, ordering a cheque book, and even getting a vehicle loan in minutes – for the most part. However, in a country as diverse and vast as India, we still have 190 million who are unbanked and despite the large number of bank accounts that have been successfully opened due to schemes such as PMJDY, merely having a bank account does not automatically translate into financial inclusion.

Are all of them financially resourced, or do they have access to credit, or are they even credit-worthy?

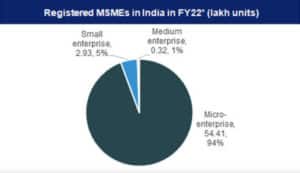

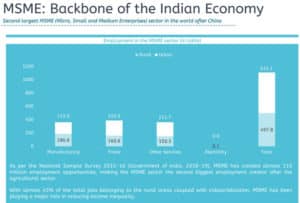

The MSME sector, according to the NSS 2015-16 created 110 million employment opportunities, a clear indication that the MSME sector is a critical and significant component of a nation’s economic wellbeing.

The sudden onset of Covid-19 created a vacuum in the MSME credit ecosystem and revenue streams for several MSMEs all but dried up. Thousands of MSMEs shut down or were struggling to pay salaries or even their loan repayments. Today, as India and the world limps back to normalcy, MSMEs are asking for credit at cheaper or even zero rates of interest. While nationalised or private banks have been mandated to ease the credit pressure, their systems and processes do not allow them to identify, assess, approve or disburse loans quickly.

This gap to credit access can, and is being bridged by fintechs and Non-Banking Finance Companies who have been able to navigate these roadblocks with greater agility. One of the biggest roadblocks for MSMEs to get loans from banks is the tedious process, rigid documentation, and the more conservative attitude of banks, especially as they are concerned with loan repayment and therefore are averse to taking a leap of faith.

NBFCs and fintechs have been bridging this gap successfully. A 2016 report by KPMG found that alternative finance had grown 264% in just one year to USD 146 billion. This vindicated the fact that even MSMEs prefer non-traditional routes of credit as they are easier, faster and simpler to procure. Fintechs including FIA have made KYC registration, or the loan approval turn-around time quicker, making NBFCs and fintechs far more attractive to the MSME community.

How is technology enabling this faster turnaround and empowering millions of MSMEs to procure loans faster and cheaper? Is it a risk worth taking for the fintechs? Can technology be a harbinger of financial inclusion and bring about a radical change in the way we empower our MSME universe?

Stay tuned to read more about finance and technology, financial inclusion and answers to a few of the above. And please don’t forget to add your comments and share your thoughts, it’s always good to have a dialogue.

Keywords: Financial Inclusion, Banking Services, Digital Lending, MSME